Our business. Our approach.

Our Focus is Silver.

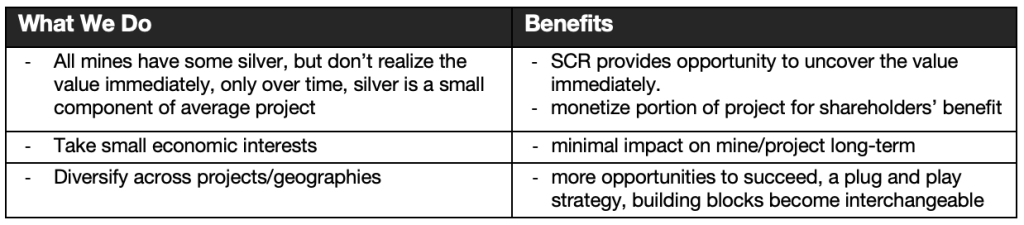

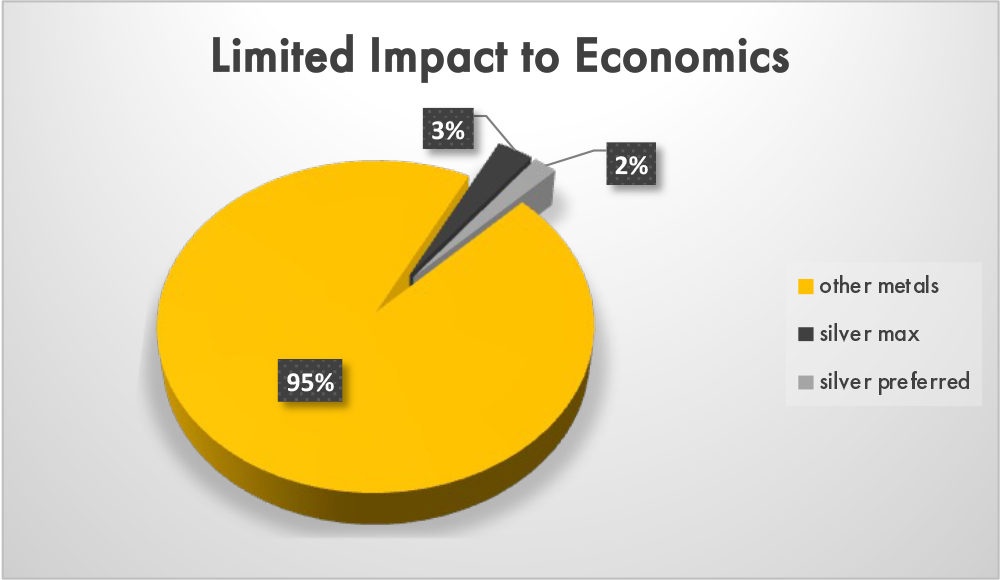

We unlock previously unrecognized value. Silver is a small part of the global market. We purchase a small portion (silver, less than 5% of overall economics) of a project and create value where others didn’t see it.

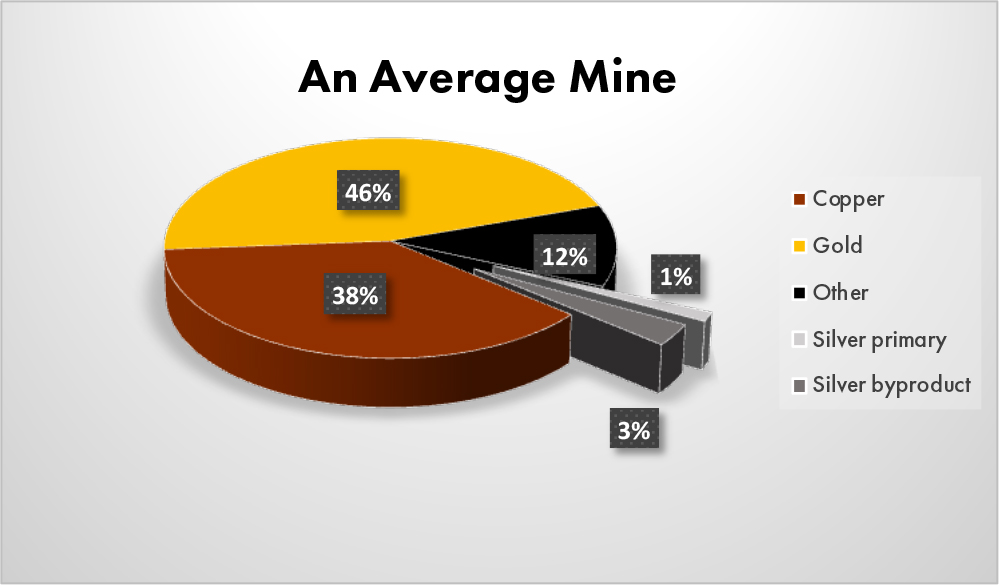

Since silver makes up a small percentage of the global metals market, it also makes up a small percentage of the average mine or project (by volume and/or by value). Silver Crown Royalties monetizes this small portion of the mining project. The Benefit: adding value where it did not exist before – for our shareholders and for the vendors.

The relatively small nature of the silver market effectively guides Silver Crown Royalties to not take large economic positions (i.e. less than 5%) in any given mining project. This is beneficial for the vendor as the impact to their operations remains insignificant.

This also directs SCR to diversify across many assets, lowering risk – be it geopolitical, geological, recovery, engineering, or otherwise. This is beneficial since SCR has more opportunities to succeed. As well, the diversification renders all building blocks interchangeable. We diversify across projects in order to build a sizeable company for our investors, reducing risk along the way.

Silver on average makes up 5% of a mine’s output, ranging from near zero to over 70%. The majority of silver comes out of the ground as a byproduct at less than 5% of total revenues.

We focus on silver for this very reason – the economic impact of committing the silver to Silver Crown Royalties for an up front and additional milestone payments is minimal – we target less than 5%, but our preference is less than 2% (the metal itself will generally trade in daily swings of 1-2%).

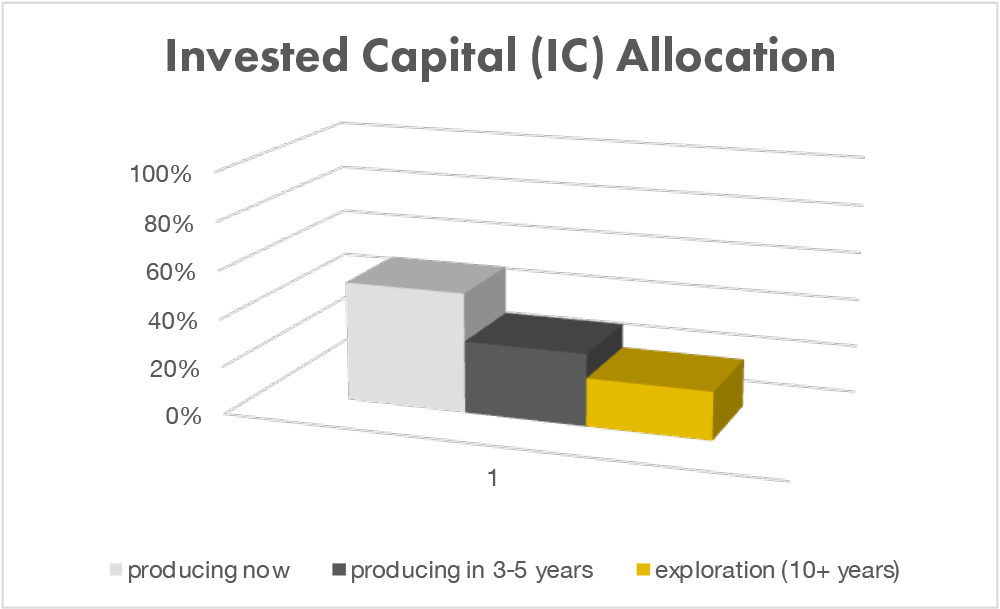

Although we favor producing assets (we are targeting 50% of our invested capital be deployed into producing mines or facilities), we appreciate the need for capital in the industry as well as the ability to secure future new production through development (3-5 years to production at 30% of invested capital), and exploration (20% of IC) royalties.

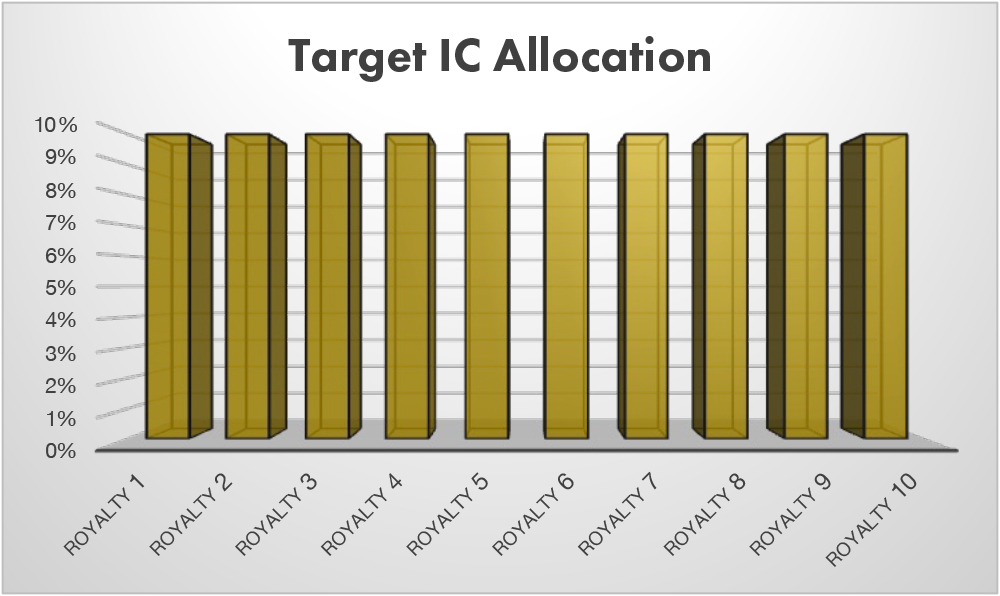

To further reduce the risk to our investors and shareholders, we target a portfolio with no more than 10% of invested capital in any given royalty. As we continue to grow, we aim to diversify further, allowing for larger transactions while not exceeding the exposure and risk by the 10% cap.